Start Saving Smarter

Banterra offers a variety of savings accounts to meet your growing needs. Whether you are planning for your child’s education or your retirement, or simply reaching personal savings goals or having a safety net for what life may throw your way, we have a saving product to help you. You can open an account online or stop by a Banterra Banking Center near you.

Your Savings Account Choices

Banterra Preferred Savings

Minimum Requirements

- $100 minimum to open

- $100 minimum daily balance in order to earn interest

Features

- Option of no monthly fee ($2 monthly fee can be avoided by maintaining a minimum balance of $100)

- Four (4) monthly withdraws at no charge (additional withdraws per month have a $2 per-item fee)

- Earn tiered interest based on your account balance

Banterra SmartKid Savings

Minimum Requirements

- $10 minimum to open

- Minimum balance of $10 required to earn interest

Features

- No monthly fee

- Three (3) monthly withdraws at no charge (additional withdraws per month have a $1 per-item fee)

- At age 22, this account will be converted to a Preferred Savings and must meet the normal criteria in order to avoid the monthly fee

Banterra Home Savings

Minimum Requirements

- $100 minimum to open and earn interest

- Tiered interest based on account balance

Features

- One-on-one guidance from an experienced Banterra Mortgage Lender

- $500 closing cost credit on a home closed with Banterra after 12 consecutive months of savings

- Four (4) monthly withdraws at no charge (additional withdraws per month have a $2 per-item fee)

- Option of no monthly fee ($2 monthly fee can be avoided by maintaining a minimum balance of $100)

$100 daily minimum balance to earn interest. Tiered interest, on account balance: $100-$24,999.99; $25,000-$99,999.99; $100,000-$249,999.99; $250,000-$499,999.99;

$500,000+.

Money Market Accounts We Offer

Earn a higher interest rate, but must maintain the liquidity of their funds with two great money market options from Banterra:

Banterra Money Market

Minimum Requirements

- $2,500 minimum to open

- No monthly fee if minimum daily balance of $1,500 or a minimum average daily balance of $2,500 is maintained per statement cycle. Otherwise, a monthly fee of $8.50 is charged

Features

- Set interest rate when daily balance requirement is maintained

- Set up automatic savings with regular transfers from your Banterra checking account

- Link to a Banterra checking account to provide 24-hour access to funds through ATM

- Link to checking for account transfers

Benefits

- Higher rates than traditional savings

- Easily access funds by ATM or check

- Utilize and view through Digital Banking

- Great way to set up automatic savings methods

Banterra Preferred Money Market

Minimum Requirements

- $10,000 minimum to open

- No monthly fee if a $10,000 minimum daily balance is maintained in combination of identified Preferred Money Market, Savings, Money Market Deposit Account, Certificate of Deposit or Home Equity Line of Credit accounts; otherwise $10 fee per statement cycle

Features

- Tiered interest at money market rates based on your daily balance within these tiers:

- $10,000 to $24,999.99

- $25,000 to $99,999.99

- $100,000 to $249,999.99

- $250,000 to $499,999.99

- $500,000 or more

- Interest will be compounded and credited monthly based on statement cycle

- Set up automatic savings with regular transfers from your Banterra checking account

- Link to a Banterra checking account to provide 24-hour access to funds through ATM

- Link to checking for account transfers

Benefits

- Higher rates than traditional savings

- Easily access funds by ATM or check

- Utilize and view through Digital Banking

- Great way to set up automatic savings methods

Banterra Health Savings Account (HSA)

A tax-advantaged personal savings account dedicated to medical expenses.

Minimum Requirements

- $100 minimum to open

- Health coverage needs to be under an HSA-qualified, high-deductible health plan (HDHP)

Features

- No annual fee

- Competitive interest rates

- Generate interest with a minimum balance of $100

Benefits

Smart funding source and easy payment options for out-of-pocket medical expenses:

- Free Banterra Visa® HSA Debit Card

- Checks for payment with no per-check fee

- Set up payees utilizing free Bill Pay

- Free Digital Banking including online and mobile

- Free usage of Banterra ATMs

- Funds roll over year to year

To utilize an HSA, no other first-dollar medical coverage (insurance such as specific injury insurance or accident, disability, dental care, vision care or long-term care insurance are permitted).

HSA customers cannot be enrolled in Medicare.

HSA customers cannot be claimed as a dependent on someone else’s tax return.

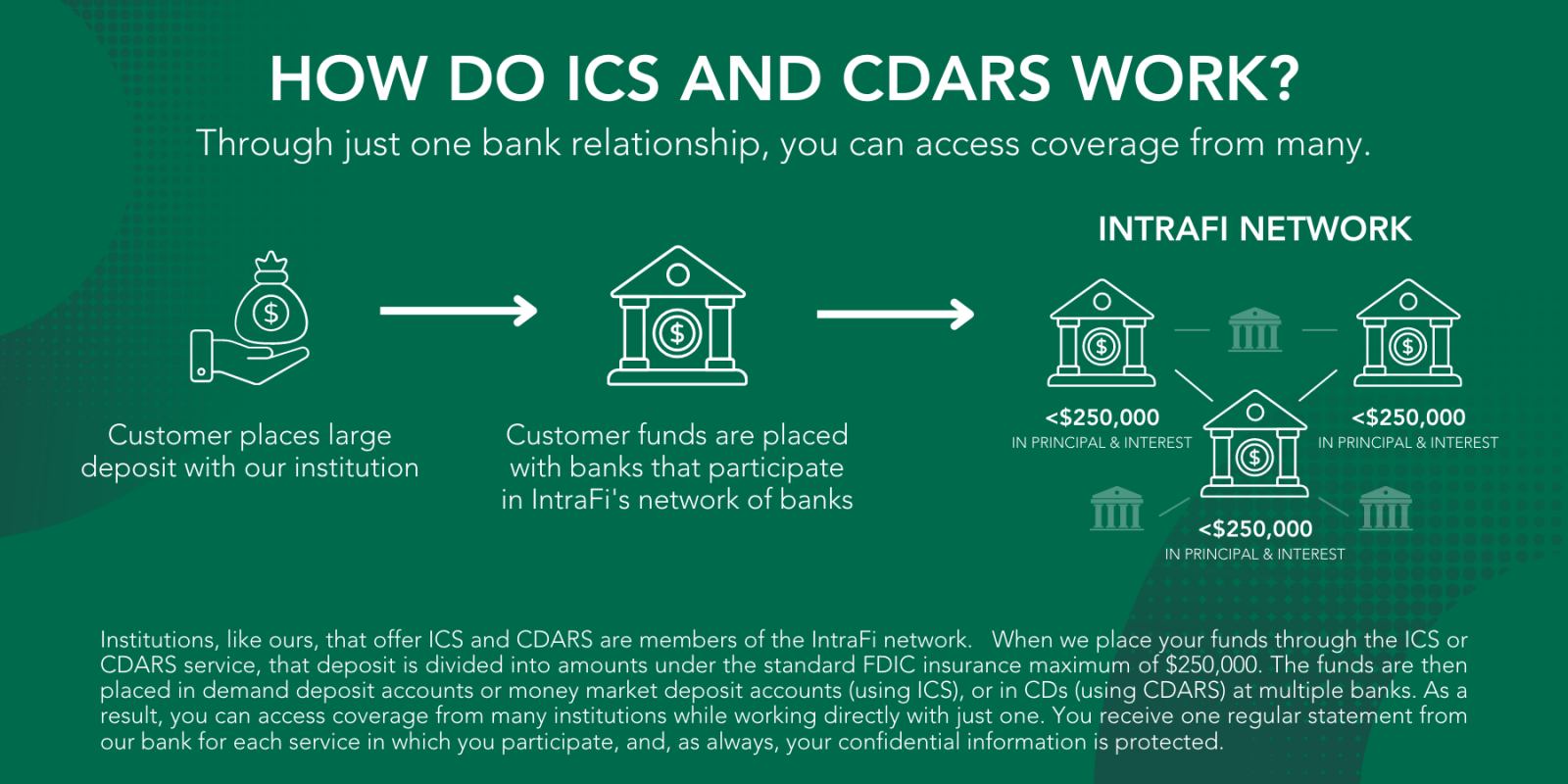

Earn Interest And Access Multi-Million-Dollar FDIC Insurance With IntraFi® Network Deposits

With IntraFi, Banterra can offer smart and convenient ways to safeguard your large deposits by using a network of banks, but with the simplicity of working with just Banterra. IntraFi product offerings include ICS (IntraFi Cash Service) - funds placed into savings or money market accounts and CDARS - funds placed into CDs.

With ICS and CDARS services, you can:

- Enjoy peace of mind knowing your funds are eligible for multi-million-dollar FDIC insurance

- Earn interest

- Save time by working directly with our bank

- Enjoy flexibility

- Know the amount of your deposit can be used to invest in your local community

By accessing the Youtube.com link above, you are leaving the Banterra Bank website and entering a website hosted by another party. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of Banterra Bank website. We encourage you to read our Terms of Use section regarding the use of links from Banterra Bank website.

Deposit placement through CDARS or ICS is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits. A list identifying IntraFi network banks appears at www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi, CDARS, One Bank One Rate One Statement are registered trademarks, and the IntraFi logo and IntraFi hexagon are service marks, of IntraFi Network LLC.

Savings Account Comparison

|

Header |

Preferred Savings | Smart Kid Savings (age 21 and under) | Money Market | Preferred Money Market | CDs & IRAs | Health Savings Account | Home Savings Account |

|---|---|---|---|---|---|---|---|

| Who Would Benefit From This Account | Great for earning interest on higher balances accounts that may occasionally have a lower balance | A great account to get started saving at an early age | The right account if balances are between $2,500 and $10,000 | Perfect for a $10,000 minimum balance account while earning more as the balance grows | A great way to have options for rates and terms on your money | The right account to pair with a high-deductible health plan in order to save and conveniently pay medical expenses | Perfect for future first-time home buyers that are saving for a down payment |

| Interest Bearing | Tiered | Yes | Yes | Tiered | Yes | Yes | Tiered |

| Minimum Opening Balance and Balance Required to Earn Interest | $100 | $10 | $2,500 | $10,000 | Varies based on product selected | $100 | $100 |

| Service Charge | $2 per statement cycle if balance falls below $100 | None | None if a minimum daily balance of $1,500 is maintained or a minimum average balance of $2,500; otherwise $8.50 per statement cycle | No monthly fee if a $10,000 minimum daily balance is maintained in combination of identified Preferred Money Market, Savings, Money Market Deposit Account, Certificate of Deposit or Home Equity Line of Credit accounts; otherwise $10 fee per statement cycle | Penalties assessed for early withdrawal | None | $2 per statement cycle if balance falls below $100 |

| Per Item Charge | $2 per item for withdrawals in excess of four per cycle | $1 per item for withdrawals in excess of three per cycle | None | None | None | None | $2 per item for withdrawals in excess of four per cycle |

| Additional Information | At age 22, account converts to a Preferred Savings and must meet the normal criteria in order to avoid the monthly fee. | A variety of terms are available | Contact any branch for additional information and qualifications | One-on-one guidance from an experienced Banterra Mortgage Lender |

| Who Would Benefit From This Account | Interest Bearing | Minimum Opening Balance and Balance Required to Earn Interest | Service Charge | Per Item Charge | Additional Information | |

|---|---|---|---|---|---|---|

| Preferred Savings | Great for earning interest on higher balances accounts that may occasionally have a lower balance | Tiered | $100 | $2 per statement cycle if balance falls below $100 | $2 per item for withdrawals in excess of four per cycle | |

| Smart Kid Savings (age 21 and under) | A great account to get started saving at an early age | Yes | $10 | None | $1 per item for withdrawals in excess of three per cycle | At age 22, account converts to a Preferred Savings and must meet the normal criteria in order to avoid the monthly fee. |

| Money Market | The right account if balances are between $2,500 and $10,000 | Yes | $2,500 | None if a minimum daily balance of $1,500 is maintained or a minimum average balance of $2,500; otherwise $8.50 per statement cycle | None | |

| Preferred Money Market | Perfect for a $10,000 minimum balance account while earning more as the balance grows | Tiered | $10,000 | No monthly fee if a $10,000 minimum daily balance is maintained in combination of identified Preferred Money Market, Savings, Money Market Deposit Account, Certificate of Deposit or Home Equity Line of Credit accounts; otherwise $10 fee per statement cycle | None | |

| CDs & IRAs | A great way to have options for rates and terms on your money | Yes | Varies based on product selected | Penalties assessed for early withdrawal | None | A variety of terms are available |

| Health Savings Account | The right account to pair with a high-deductible health plan in order to save and conveniently pay medical expenses | Yes | $100 | None | None | Contact any branch for additional information and qualifications |

| Home Savings Account | Perfect for future first-time home buyers that are savings for a down payment | Tiered | $100 | $2 per statement cycle if balance falls below $100 | $2 per item for withdrawals in excess of four per cycle | One-on-one guidance from an experienced Banterra Mortgage Lender |