Save Your Way For Your Business

Saving is a smart strategy for any business. With Banterra’s business savings accounts, you have the flexibility you need to make the most of your money while maintaining security and earning a competitive interest rate. Most importantly, you can access your account at your convenience with our digital banking services. You can apply for your business savings account by clicking the button below. If you need assistance, a Banterra representative is ready to help you determine which account is right for your business. Contact your local banking center to connect with a representative.

Compare Our Business Savings Accounts

| Placeholder Header | Preferred Savings | Money Market | Preferred Money Market | Certificate of Deposit | CDARS® (Certificate of Deposit Account Registry) |

|---|---|---|---|---|---|

| This account is: | Great for earning interest on higher balance accounts that may occasionally have a lower balance | The right account if balances are between $2,500 and $10,000 | Perfect for a $10,000 minimum balance account while earning more as the balance grows | A great way to have options for rates and terms on your money | The right CD for you if you want a single statement yet have large deposits needing FDIC coverage through multiple banks |

| Interest Bearing | Tiered | Yes | Tiered | Yes | Yes |

| Minimum Opening Balance And Balance Required To Earn Interest | $100 | $2,500 | $10,000 | $1,000 to $25,000; see CDs Comparison Chart | Varies based on product selected |

| Monthly Fee | $2 per statement cycle if balance falls below $100 | None if you maintain a minimum daily balance of $1,500 or a minimum average balance of $2,500; otherwise $8.50 per statement cycle | No monthly fee if a $10,000 minimum daily balance is maintained in combination of identified Preferred Money Market, Savings, Money Market Deposit Account, Certificate of Deposit or Home Equity Line of Credit accounts; otherwise $10 fee per statement cycle | Penalties assessed for early withdrawal | Penalties assessed for early withdrawal |

| Per Item Charge | $2 per item for withdrawals in excess of four per cycle | None | None | None | None |

| Additional Information | A variety of terms are available | A variety of terms are available |

| Placeholder Header | This account is: | Interest Bearing | Minimum Opening Balance And Balance Required To Earn Interest | Monthly Fee | Per Item Charge | Additional Information |

|---|---|---|---|---|---|---|

| Preferred Savings | Great for earning interest on higher balance accounts that may occasionally have a lower balance | Tiered | $100 | $2 per statement cycle if balance falls below $100 | $2 per item for withdrawals in excess of four per cycle | |

| Money Market | The right account if balances are between $2,500 and $10,000 | Yes | $2,500 | None if you maintain a minimum daily balance of $1,500 or a minimum average balance of $2,500; otherwise $8.50 per statement cycle | None | |

| Preferred Money Market | Perfect for a $10,000 minimum balance account while earning more as the balance grows | Tiered | $10,000 | No monthly fee if a $10,000 minimum daily balance is maintained in combination of identified Preferred Money Market, Savings, Money Market Deposit Account, Certificate of Deposit or Home Equity Line of Credit accounts; otherwise $10 fee per statement cycle | None | |

| Certificate of Deposit | A great way to have options for rates and terms on your money | Yes | $1,000 to $25,000; see CDs Comparison Chart | Penalties assessed for early withdrawal | None | A variety of terms are available |

| CDARS® (Certificate of Deposit Account Registry) | The right CD for you if you want a single statement yet have large deposits needing FDIC coverage through multiple banks | Yes | Varies based on product selected | Penalties assessed for early withdrawal | None | A variety of terms are available |

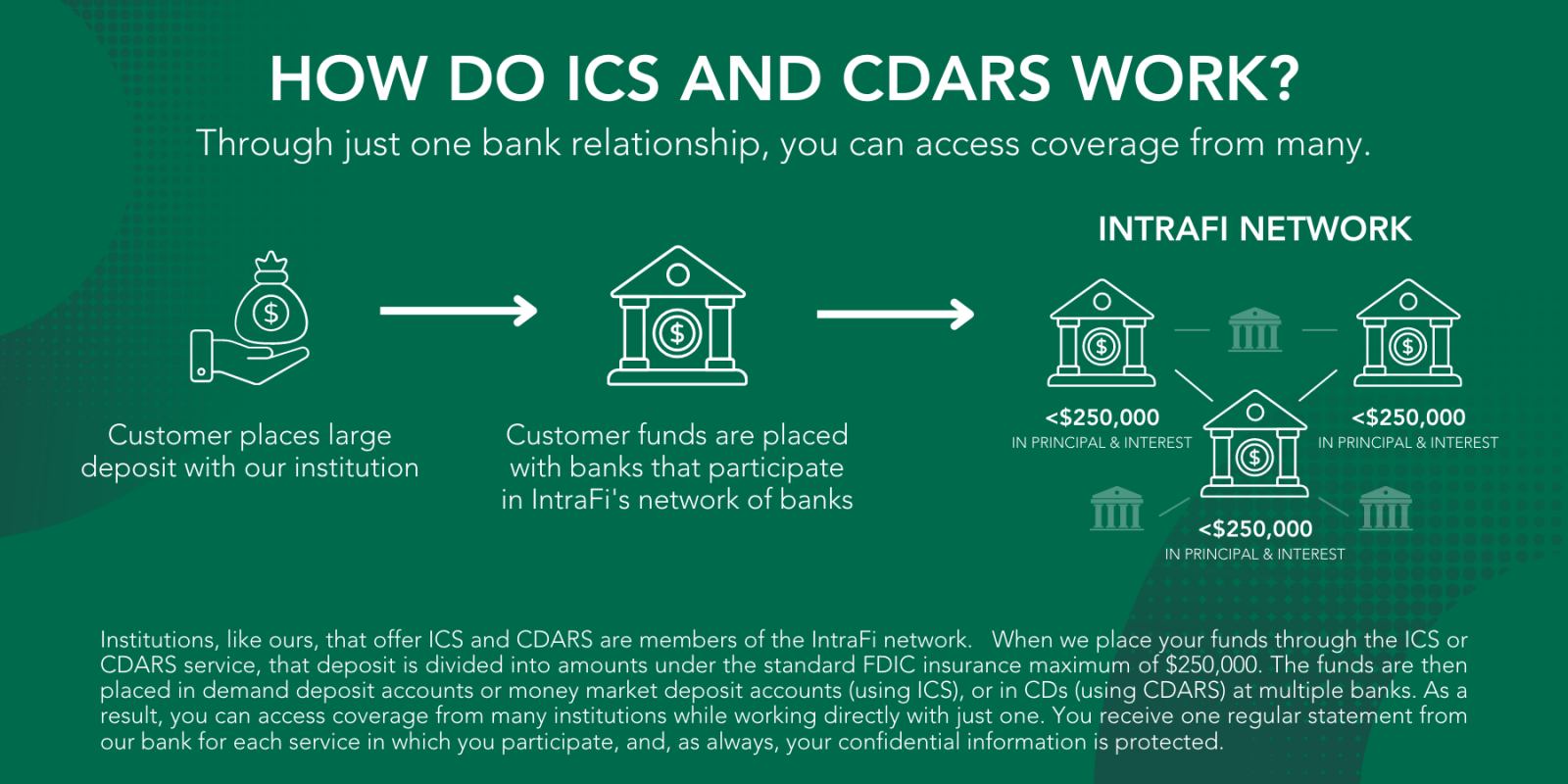

Earn Interest And Access Multi-Million-Dollar FDIC Insurance With IntraFi® Network Deposits

With IntraFi, Banterra can offer smart and convenient ways to safeguard your large deposits by using a network of banks, but with the simplicity of working with just Banterra. IntraFi product offerings include ICS (IntraFi Cash Service) - funds placed into savings or money market accounts and CDARS - funds placed into CDs.

With ICS and CDARS services, you can:

- Enjoy peace of mind knowing your funds are eligible for multi-million-dollar FDIC insurance

- Earn interest

- Save time by working directly with our bank

- Enjoy flexibility

- Know the amount of your deposit can be used to invest in your local community

By accessing the Youtube.com link above, you are leaving the Banterra Bank website and entering a website hosted by another party. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of Banterra Bank website. We encourage you to read our Terms of Use section regarding the use of links from Banterra Bank website.

Deposit placement through CDARS or ICS is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits. A list identifying IntraFi network banks appears at www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi, CDARS, One Bank One Rate One Statement are registered trademarks, and the IntraFi logo and IntraFi hexagon are service marks, of IntraFi Network LLC.